The NEO Home Loans Experience

Our goal is to help you become a more educated, empowered, and confident home buyer.

We have a three-part approach to add significant value to your real estate and financial portfolio.

Our Process

Step 1 Discovery

Before we prescribe a mortgage strategy, we inquire about your goals an dcurrent financial situation.

Step 2 Strategy

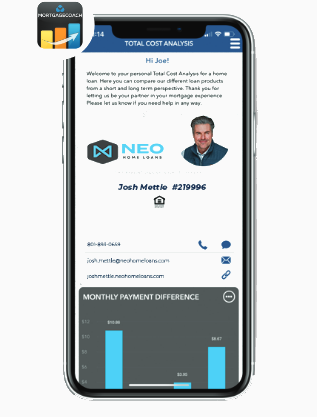

We analyze your financial goals and present you with a Total Cost Analysis - a digital and easy-to-read breakdown of your mortgage options.

Step 3 Execution

We create a flawless mortgage experience for you.

Step 4 Wealth Maximization

The closing of your loan is just the start of our relationship.

Before While you shop for your home

Identify your Financial Goals

The Discovery Consultation is where we learn about you, your financial situation, and your financial goals.

Analyzing your current financial situation and long-term goals before prescribing you a loan product will maximize your wealth and set you up for a FAST and SUCCESSFUL homebuying experience.

Execute an Upfront Market Analysis

To be able to leverage all the details you need to make a confident, smart decision in a real estate transaction, knowledge on the current state of the housing market is a must.

We want you to feel comfortable and confident when you decide to make an offer on a new home. This means understanding the data so you know WHY the market is moving the way it is.

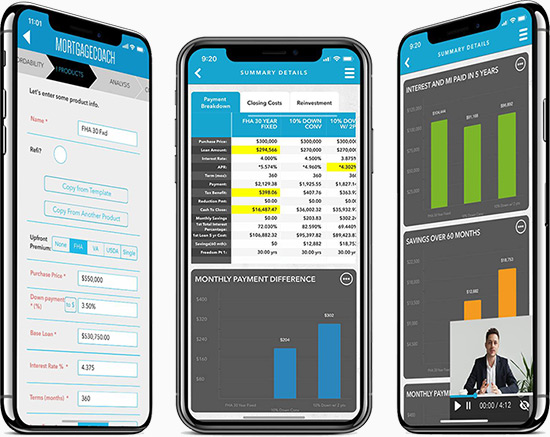

Create and review your Total Cost Analysis

Historically, mortgage planning has focused only on the cost of the loan, with very little regard for the overall financial strategy.

You deserve a Total Cost Analysis of all your mortgage options, and a breakdown of how your mortgage will impact your financial future.

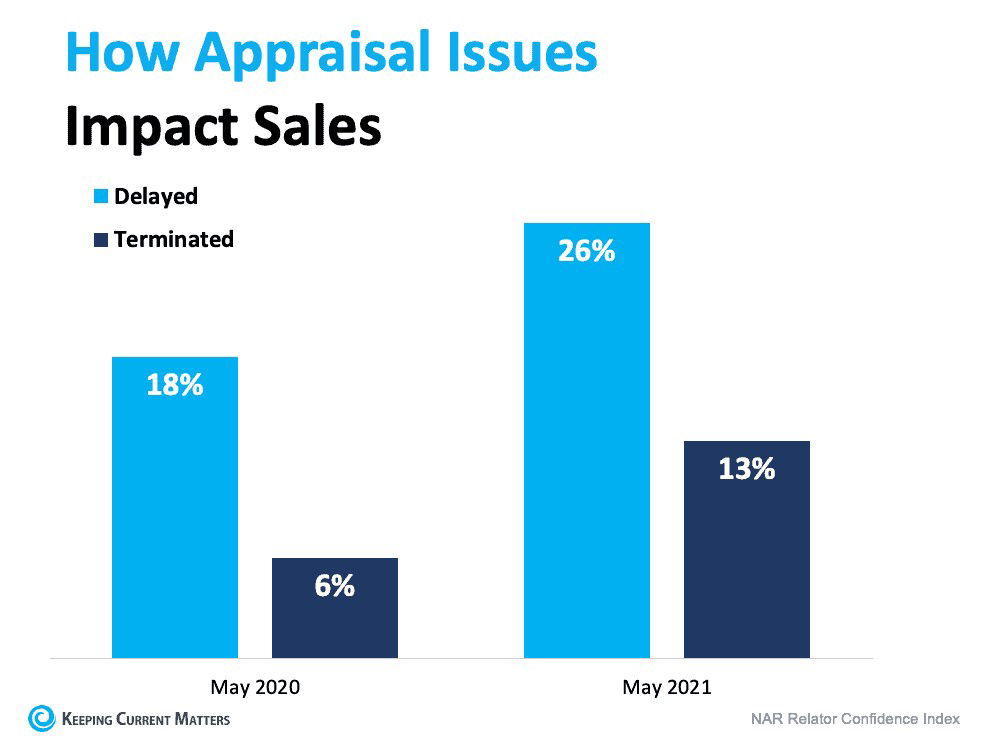

Prepare an Appraisal Gap Strategy

Appraisal gaps are becoming more common as home appreciation continues to rise and competition for housing intensifies. However, a low appraisal does not have to end in a canceled deal – it just means you have to pivot and renegotiate.

Creating an Appraisal Gap strategy at the beginning of the loan process is crucuail so if your appraisal does come in low, you are prepared to pivot and continue your home purchase without any delays.

Obtain a Fully Underwritten Pre-Approval

A fully underwritten pre-approval letter is a requirement when buying a home today.

It shows sellers you are a qualified buyer who will be able close quickly and efficiently. It allows you to remove loan contingencies and even compete with all-cash offers.

During Your escrow and contract period

Submit an All-Cash Offer

As a well-qualified buyer, you should be able to have a fighting chance in this market and compete with someone who has very deep pockets.

To allow you the ability to make an all-cash offer, NEO Home Loans has partnered with a company called Revive. All you must do is obtain a fully underwritten pre-approval from our team, and then Revive will buy the home on your behalf in cash and sell it back to you.

Final Approval

We stay in constant communication with you and your Realtor throughout the loan process. As we near final underwriting approval, we help coordinate your closing for a low-stress and flawless home buying experience.

Closing

Our goal is to provide you with the final documents and cash needed for closing at least 48 hours prior to your home loan settlement.

Working together with your Realtor and your closing agent, we will ensure you have all the information you need for a smooth settlement.

Updater

Organize and complete all your moving tasks in one place. Automatically forward your mail, connect or transfer utilities, change your cable/internet and more.

After As you build wealth through real estate

Home Concierge Service

Maintain your home with all of your records and service providers in one place. Househappy allows you to take care of all your home project needs with a simple phone call or click and all your home’s information is stored and always available to you through your Househappy account.

Monthly Real Estate Wealth Digests

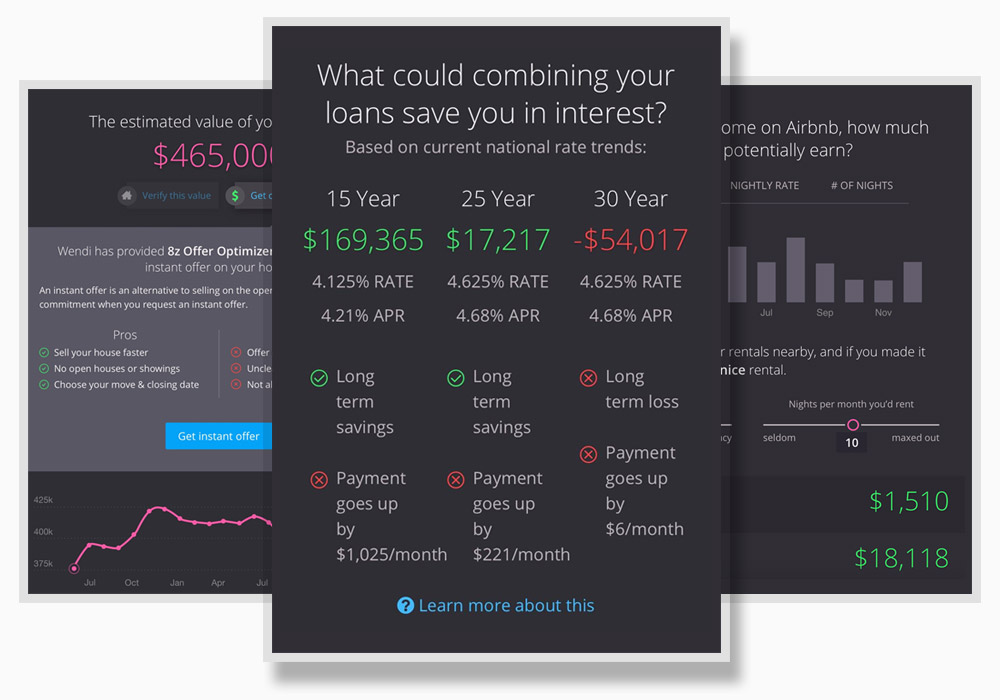

After your loan closes, we provide you with a monthly Real Estate and Wealth Digest for your home.

This report provides you with valuable insights on your home’s net worth as it grows.

Annual Financial Review

Be sure that you are making the best decisions for your family by planning for the future and getting continual advice and guidance on how to navigate your real estate and finances.

Perfect Mortgage Promise

As your life changes and evolves over time, the way you manage your real estate and mortgage should change and evolve with it.

Our commitment to you is to help you Master the Art of Homeownership and ensure that you are always in the perfect mortgage, with the perfect mortgage plan.